New: financial assistance hub

11 March 2021

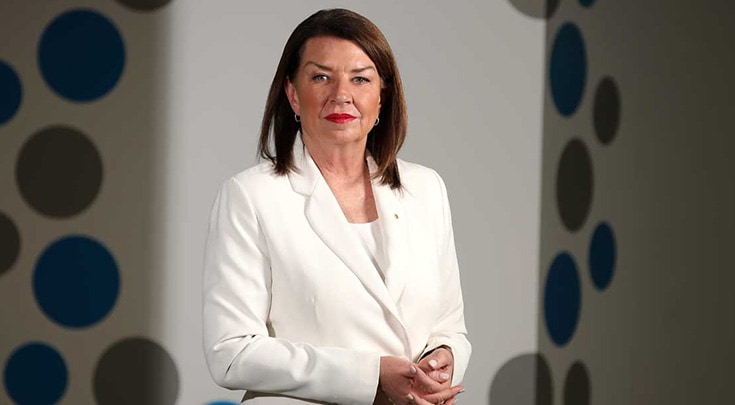

Interviewed on ‘Money News’ by Brooke Corte, ABA CEO Anna Bligh discusses the practical help banks can provide to customers impacted by COVID-19.

TRANSCRIPT SPEAKERS: 2GB’s host of ‘Money News’, Brooke Corte, ABA CEO Anna Bligh

Brooke Corte: There are some other worrying signs emerging at the household level if you read the media today and absorbed the coverage in the media today. That was done in a survey by the comparison website Finder.

Now this survey got quite a lot of coverage because it revealed what I thought was actually a pretty alarming statistic too, that about a third of Aussie mortgage holders are now more than 30 days behind in their payments. So 1 in 3 having trouble with their mortgage, a grim warning for Aussie mortgages as news.com.au I saw splash with the headline today and look I can imagine people are clicking on stuff like that.

We’ve got a lot of worries around at the moment. We got the end of JobKeeper approaching, the mortgage holidays, they’re being wound up. So, of course, we’re worried about cracks appearing in this incredible economic recovery story that we have. Let’s chat with Anna Bligh – she’s the CEO of the Australian Banking Association. She joins us on the line now. Anna Bligh welcome.

Anna Bligh: Great to be with you.

Brooke Corte: Are more Australians falling behind on mortgage repayments?

Anna Bligh: Well, what we are actually seeing is the opposite of what this article is telling us. I don’t know the source of this, I do know from the article that it was done from a survey of just over 440 customers.

What the official data tells us is that there are six million people in Australia that have a mortgage and it’s much closer to 1% of them who are experiencing some form of arrears. It’s not two million as this article might make you wonder. It’s down to about 60,000 now. At 60,000, that’s still a lot of people, but it’s not enough to threaten the stability of the banking system as a 30% number might, but it’s still a lot of people.

Brooke Corte: Yeah I think the survey like that with a result like that gets a run, because there is this inherent concern about the end of JobKeeper coming up within weeks, we’ve got the end of the home loan deferrals from major banks, people are worried about those who are feeling vulnerable and how they’ll be faring.

Anna Bligh: And I can certainly understand those concerns. For those people who are still not back at work or who are back at work, but with a really significant drop in their hours, of course they’re worried about their income and they’re worried about meeting all of their liabilities, whether it’s credit card payments, their car loan, or if they have a mortgage, but right at the height of COVID, when things were at their absolute worst, only 10% of Australian mortgage holders deferred the payments on those mortgages. 90% of those people are now back paying in full.

So even at the height of COVID when everything was at its most uncertain and in lockdown we didn’t have 30% of mortgage holders deferring their mortgage payments. It’s much closer to 1%.

Brooke Corte: OK let’s talk about that 1% because someone listening might be in that scenario. What do they do at this point?

Anna Bligh: By this point I would have expected that most people will have already had some initial contact from the bank. Banks have, in most cases, doubled the number of staff in their hardship team. So they can work individually with each customer to tailor the right solution for them.

Banks have actually got a lot of tools in the toolkit as people are coming out of this recession, they can do some very practical things. For example, give you a new mortgage that is over a longer-term, has a lower interest rate, might have a period of interest-only payments – all designed to have much much lower payments for a temporary period until you can get back into the workforce or, you know, if you’re a Qantas pilot, back to flying in the air.

Brooke Corte: It’s interesting I am listening to you, you sound like a sympathetic friend trying to help but you’re representing the banks, Anna Bligh. They like making money, don’t they?

Anna Bligh: Well of course they do and they do that for their shareholders and for their deposit holders and most of us have a deposit somewhere, but if we think about it, if you’ve got a customer who has had a mortgage for 10 years, they’ve never missed a payment, they haven’t had any period of unemployment, they’ve got good skills, the best thing for you as the bank is for them to keep that mortgage and pay it off. So there’s a lot of commercial alignment with the interests of customers here.

“Banks have actually got a lot of tools in the toolkit as people are coming out of this recession, they can do some very practical things. For example, give you a new mortgage that is over a longer-term, has a lower interest rate, might have a period of interest-only payments – all designed to have much much lower payments for a temporary period until you can get back into the workforce or, you know, if you’re a Qantas pilot, back to flying in the air”

ABA CEO Anna Bligh

Brooke Corte: Anna Bligh, the other big story at the moment is the property price surge, I don’t think we are calling a boom just yet but we’ll call it a surge it certainly is that, the thing that’s interesting to me is that there is this growing belief amongst the experts and the commentators out there that someone will have to kind of step in and slow things down probably towards the end of the year and most likely the banking regulator.

The thing that I’m interested in is the first home buyers are the ones that they seem to be fueling the recent spiking in borrowing which I think makes it tricky to work out exactly how the banking regulator might slow things down. I mean they are hardly going to want to kill the great Australian dream for young Australians. So what do you think is likely to happen.

Anna Bligh: If we listen to what, particularly the Governor of the Reserve Bank has said in a number of public statements over the past week. I think we have a very clear indication that he believes that his interest settings are right. He is very concerned to make sure that banks maintain good lending standards, he has said that what he sees at the moment is good lending standards. What that means is banks are lending to people who can afford to pay, not only afford to pay now, but they could afford to pay if interest rates were to go up in a few years’ time.

However, if he started to see any of those standards slip then he would be wanting to look at levers from other regulators that might curb that. Now what I can say is that banks are acutely aware of the need in these circumstances — we are still in a tough economy — to be careful who they lend to but you are right, what we are seeing in the data at the moment is that overwhelmingly the people who are buying property at the moment are owner occupiers.

Remember, there are a number of incentives in the system for first home buyers both at state and federal government levels around the country. So I think there’s some interesting things for the regulators to be looking for over the second half of the year. Yes, most people would think that if first home buyers are able to get in because of those incentives and low interest rates that’s not a bad outcome, as long as things can be maintained at high levels of credit standards.

Brooke Corte: Anna Bligh. Thank you very much from the Australian Banking Association appreciate your time on Money News.

Anna Bligh: Thanks a lot.

Latest news

The ABA is reminding customers across North and Far North Queensland that they don’t have to tough it out on their own, as they continue to recover from February’s severe flooding event. ABA CEO Anna Bligh recently met with Queensland’s State Recovery Coordinator Andrew Cripps to discuss how banks can assist customers facing financial difficulty… Read more »

Banks stand ready to support customers in western Queensland and parts of New South Wales affected by heavy rainfall and flooding. ABA CEO Anna Bligh said customers don’t have to tough it out on their own and banks have a range of practical measures to assist those facing financial stress. “This is a challenging time… Read more »

The Australian Banking Association (ABA) welcomes the release of the 2025-26 Federal Budget that maintains confidence in our financial system. The ABA welcomes initiatives to: “This Budget provides extra support to Australians in the short-term whilst at the same time helping to address some of our longer-term challenges,” Ms Bligh said. “There are modest measures… Read more »