15 December 2023

The ABA welcomes the release of the ACCC’s retail deposits inquiry final report today, saying competition in the Australian banking sector is critical to good customer outcomes and the Report shows that it is strong in the Australian context.

“2023 has seen highly competitive market forces at work in banking from which consumers are the clear winners,” ABA CEO Anna Bligh said.

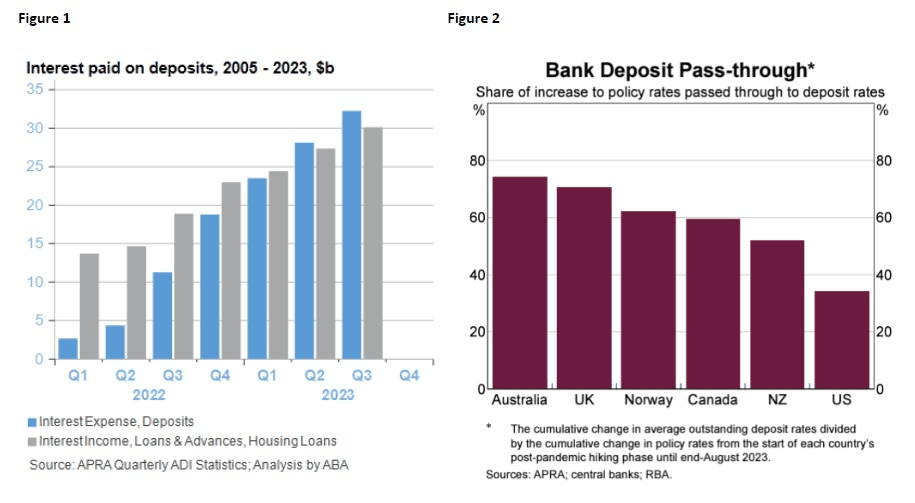

“In 2023 banks paid record levels of interest to deposit holders. In fact, throughout this year banks have paid more interest on deposits across retail, business and institutional accounts than they have received from mortgages.” (Figure 1).

Australian banks are also passing on more interest to their customers than banks in other countries Ms Bligh said, with interest rates on deposit products increasing in line with changes to the cash rate.

“The share of interest passed onto customers in Australia is higher than in the United Kingdom, United States, Norway, Canada and New Zealand,” Ms Bligh said, (Figure 2).

Record rates of mortgage refinancing happening in recent years shows customers are engaged in their finances and actively seeking better rates for them and their families. When Australians want to switch, they do,” said Ms Bligh.

“Over the past two years more Australians have changed their mortgage provider than ever before, with nearly 850,000 mortgages refinanced from one lender to another.”

With more than 900 transaction and savings deposit products available to Australian consumers, banks understand that at times some consumers may struggle to decide what products are best for them. Banks are always focused on making improvements to product offerings in the best interest of their customers and will consider each of the recommendations of the ACCC Report.

The ABA looks forward to participating in Treasury’s consultation in 2024 to consider the recommendations in more detail.

Latest news

Australians have now used Confirmation of Payee over 100 million times since the service was launched in July 2025, marking a major milestone in the banking industry’s efforts to protect consumers and businesses from scams and mistaken payments. Part of the banking sector’s Scam-Safe Accord, Confirmation of Payee adds another layer of protection by allowing… Read more »

Banks are urging Australians to side-step fake or dodgy tickets this footy season, as scammers set their sights on fans across all football codes. More than $36 million was lost to buying and selling scams last year, including fake ticket sales, with criminals looking to cash in on the excitement and passion of footy fans…. Read more »

E&OEPodcast InterviewThe Savings Tip Jar18 February 2026. Topics: Mortgage refinancing, savings accounts. Dominic Beattie (Host): Welcome to this week’s Dollar Dialog, and today we’re talking refinancing, with new data dropping from the ABS last week, showing that a record 640,000 Australian mortgages were refinanced through 2025, which is up 20% on the previous year. So,… Read more »