Australian banks join new Fraud Reporting Exchange digital platform to help halt payments to scammers

16 May 2023

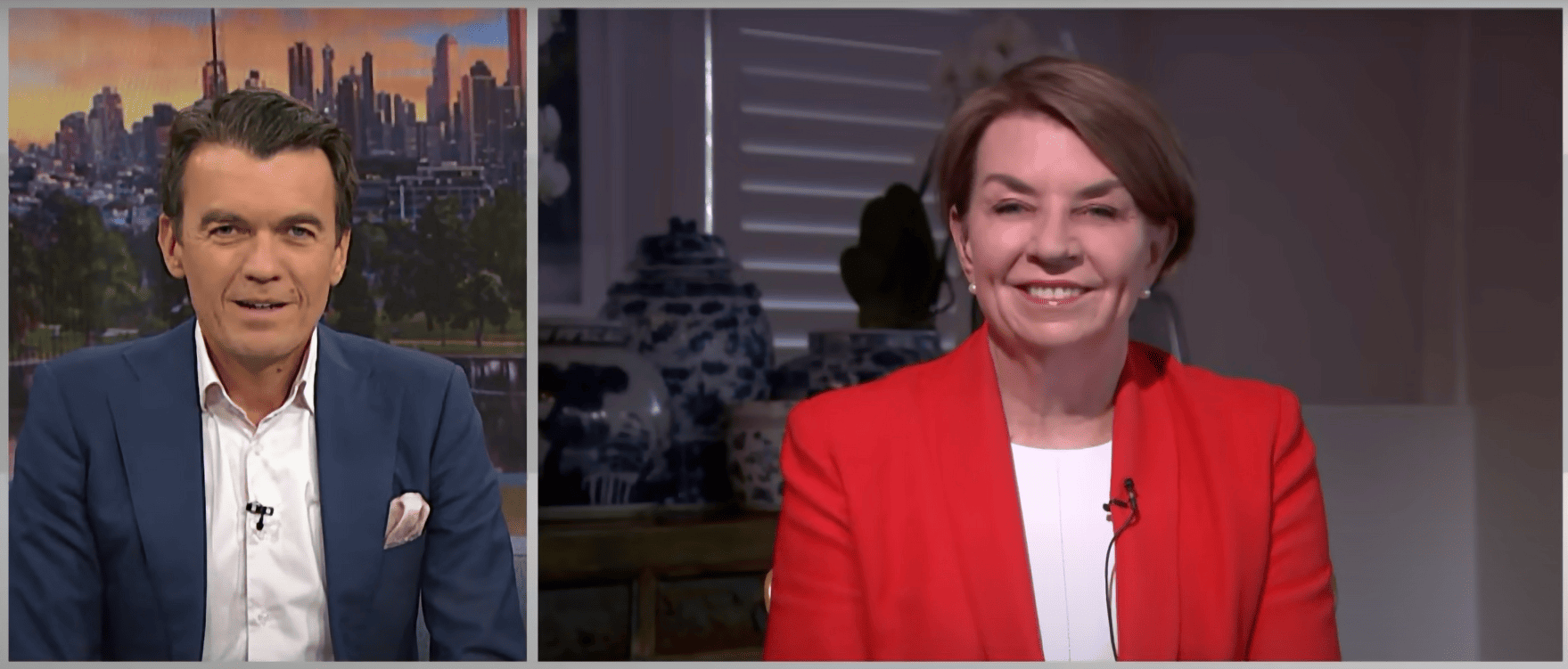

MICHAEL ROWLAND: Now let’s go back to one of our major stories this morning, Australian banks are launching a new tool to prevent customers losing even more money to scammers. The new platform, called the Fraud Reporting Exchange, aims to speed up reporting between banks about suspect payments. For more, let’s bring in from Sydney, the Chief Executive of the Australian Banking Association, Anna Bligh. Good morning to you.

ANNA BLIGH: Good morning, Michael.

MICHAEL ROWLAND: How will this work in practice, this new platform?

ANNA BLIGH: Michael, put simply, this platform will allow banks in almost real time to very quickly communicate. Where they can see that a customer has made a payment to a scammer, they can see the money’s gone to another bank, they can get it frozen, and have the best possible chance of getting that money back for the customer. It’s not going to stop every scam. It’s not going to recover every dollar every time, but it will go a very long way to improving the speed. When a scammer is trying to get money out of your account, the next thing they try to do is get it out of the country. So speed really matters. This is new technology built and funded by Australian banks, and I think it’s very bad news for scammers.

“Speed is the essence when it comes to getting your money back from a scammer. Even if you’re not sure, even if you just suspect something’s not right, ring your bank as fast as you possibly can.”

ABA CEO Anna Bligh

ANNA BLIGH: Let’s hope it is. So it’s been built – this new platform – in response to clear weaknesses in the system that scammers have been able to exploit.

ANNA BLIGH: Well, it’s really about speed. Banks already communicate with each other, but they’re using telephones and emails and that’s sometimes just too slow. This new technology, which we think is world leading – we know that UK has started to talk about building something similar – but we’re not aware of a real time platform like this anywhere else in the world. So it’s putting Australia at the forefront of the fight against scams. I think with the announcement yesterday by the Government of the new National Anti-Scams Centre, new technology like this, it’s all about making Australians safer. But you’ve always got to stay one step ahead of these scammers. They have very sophisticated international criminal gangs, so we need to put everything into the fight.

MICHAEL ROWLAND: Have banks have been forced to step up their anti-scam departments and fraud detection units in response to what is sadly, a clear increase in scamming?

ANNA BLIGH: They certainly have, I think for everybody in the senior ranks of Australia’s banks, scams are in the top three things that they worry about every single day. Just to give you some idea, just one major bank on average in Australia, would have about 500 people in their financial crime team. So that’s about 2,000 people across the four major banks. Australian Signals Directorate employs about 500 people. So it’s a massive effort from very technically capable, forensically trained people out there every minute of every day, trying to stop scams and chase money to get it back to customers. It’s a very big investment, because one of the core functions of a bank is to keep your money safe.

MICHAEL ROWLAND: And finally, Anna Bligh, let’s finish on a practical note. What advice do you have, as the head of the Australian Banking Association, for people who see their bank account and see something is clearly wrong or that scamming has occurred? What should they do in the first instance?

“…we are not aware of a real time platform like this anywhere else in the world. So it’s putting Australia at the forefront of the fight against scams.”

ABA CEO Anna Bligh

ANNA BLIGH: Michael, speed is the essence when it comes to getting your money back from a scammer. Even if you’re not sure, even if you just suspect something’s not right, ring your bank as fast as you possibly can. By definition, a scam is a payment that you authorised, so it’s not obvious to the bank that you didn’t mean to do this. You need to identify that as fast as you can. Even if you’ve just got a bad feeling in your tummy that it’s not right, call your bank. Because the more time you give them, the faster they can get on it and get your money back to you.

MICHAEL ROWLAND: Anna Bligh, the head of the Australian Banking Association, appreciate your time this morning. Thank you.

ANNA BLIGH: Thanks, Michael.

Latest news

Michael McLaren (Host): Well, here we are at the Easter Show, the great celebration of country life in the city, but it’s also an important platform this to better understand the challenges that the regions face. Now, yesterday, we looked at the floods. Today, I want to look at the banks. Now in the regions,… Read more »

The ABA is reminding customers across North and Far North Queensland that they don’t have to tough it out on their own, as they continue to recover from February’s severe flooding event. ABA CEO Anna Bligh recently met with Queensland’s State Recovery Coordinator Andrew Cripps to discuss how banks can assist customers facing financial difficulty… Read more »

Banks stand ready to support customers in western Queensland and parts of New South Wales affected by heavy rainfall and flooding. ABA CEO Anna Bligh said customers don’t have to tough it out on their own and banks have a range of practical measures to assist those facing financial stress. “This is a challenging time… Read more »