24 November 2023

Australian Banking Association CEO Anna Bligh:

Today Australia’s banking system is coming together to launch the most comprehensive set of new anti-scam reforms.

With a level of unprecedented cooperation, banks, commercial banks, building societies, credit unions, and mutual banks have joined together to commit to a set of anti-scam reforms to keep Australians and their money safer.

This means that whoever you bank with, whether you bank with Australia’s smallest credit union, or largest bank or anything in between, you will be covered by these new protections.

These new protections include a $100 million investment into a new system that will allow banks, large and small, to accurately match the name of the account with the BSB and account number. This is an Australian first, and it will keep customers safer.

We’ll see banks introducing limits and stops on transfers to high-risk cryptocurrency platforms. We know these cryptocurrency platforms can sometimes be the getaway vehicle for money that has been scammed off customers. With this initiative, it means that customers can be certain that their money is not going to head off overseas and be unable to be recovered.

Thirdly, this package of reforms will see banks introducing more warnings, and more delays and more friction in the transfer of money, particularly to new accounts. This means that things won’t happen at such a speed that scammers make sure you can’t get the money back.

The package will also see banks using at least one biometric check when [customers] open new accounts. This is a very important part of ensuring that when new accounts are being opened, it is a real person, and it is the person who belongs to the identification. We know that too often Australians are having their identification documents stolen, and those are being used to set up accounts that have been used for criminal activity. So, putting this in place, again, keeps the whole system safer.

So, what this means for customers is a much, much safer system. Customers though might see some more warnings, more delays and a little more friction in some of their banking activity, but this is all designed to keep them and their money safe. What scammers can expect is an Australian banking system that is much harder to penetrate, and much harder to rip off Australians.

I thank the ACCC for authorising the discussions that were required to allow banks to reach this agreement, and I particularly thank our colleagues in the community and banking sector, because it does mean that it doesn’t matter who you bank with, these protections will be extended to you.

I’d like to invite my colleague Mike Lawrence, who’s the CEO of the Community Owned Banking Association, to make some comments.

Community Owned Banking Association CEO Mike Lawrence:

Thank you very much Anna. The Customer Owned Banks are really proud to be standing here united with banks right across Australia.

This is a significant issue for all Australians. Last year alone, we know from the Scamwatch data that over $3 billion was scammed from everyday Australians. It is a significant issue that we need to confront collectively.

We at the Customer Owned Banks represent credit unions, building societies, and mutual banks. There’s 58 of us right across Australia. And what this Accord means is that we are going to have a set of standards that are consistent across all banks. So, from a customer’s perspective, it doesn’t matter if you are banking with the smallest regional credit union or one of the largest major banks, we are all taking a consistent approach to this.

At the Customer Owned Banking Association, we focus very much on people and communities, and this goes to the heart of our purpose and what we’re doing on the scams front is no exception.

There is, however, acknowledgement that there is a broader ecosystem in which we’re a part of, and banks are just part of that ecosystem, and we need to continue to work with government and industry such as telecommunication, digital platforms, social media, to work together in terms of fighting the scam.

And of course, the customer themselves have a part to play, and they need to remain vigilant as well. And as I said, we’re very proud to be standing united on this front. Thank you.

Assistant Treasurer Stephen Jones MP:

Thanks, Anna. Thanks, Mike. I’m delighted to be here and really excited about this announcement and the initiative, and I want to congratulate Mike Lawrence in relation to the work that he’s been doing with the Customer Owned Banking Association, and Anna and her colleagues, and Peter King who will say a few words in a moment as the Chair of the ABA.

Look, this is a big problem: $3 billion a year being lost to scams and the numbers on the rise. We know that if we don’t take an ecosystem approach, we won’t take the fight up to the scammers and the number will get bigger.

So, working with the banks, working with the social media platforms, working with the telecommunications companies is a high priority. The Albanese government has made this a target. So earlier this week, my colleague Claire O’Neill outlined the cyber strategy. And this is an integral part of an overall government program to keep information safe, and to keep money safe. Keeping money safe ensures that we have high standards in our banks, high standards in our telecommunications companies, and high standards in our digital platforms.

What I like about the voluntary initiative the Australian Bankers Association and COBA have announced today is, in particular, the confirmation of payee. Yes, it’s about ensuring that customers don’t inadvertently punch in a number that they think is the right payee only to be losing their money to a scammer that will have an immediate benefit.

It will have a benefit in relation to invoice interception and in invoice fake scams that are losing small businesses so much money. So it’s going to be a big initiative, and I welcome the fact that the Small Business Ombudsman has backed this announcement in as well, and I thank him for his comments.

So it will have a benefit in relation to invoice interception and invoice scams, but it’s also going to help everyday consumers who inadvertently punch the wrong number in, thinking they’re making the right payment, mainly because of making an error sending the money off to the wrong account. So many benefits for this, and I welcome it.

I also welcome the initiative that the banks are taking collectively in relation to mule accounts. These are used as an off ramp for criminals to rip money off victims, and then get it out of the bank and then out of the country. Cracking down on the mule accounts is cracking down on the off ramps, which the criminals are using to scam their victims.

So these two initiatives will have an immediate impact, and I’m pretty sure that Peter King from Westpac will be able to give you some numbers on what that means in relation to his bank, which is pretty impressive.

This is a voluntary initiative on behalf of the banks, and we’ve been working closely with them as a government. In the very near future, we’ll be setting out our frameworks for new compulsory codes of practice and you can anticipate the confirmation of payee will be a key element of that. The codes of practice will not just be imposed upon the banks, but the social media platforms and the telecommunications companies as well and my colleague Michelle Rowland is working in lockstep with myself and the industry on those issues.

This has got to be a Team Australia moment. We’ve all got to work together, and unless we get all parts of the ecosystem working together, we won’t beat the scammers. Our objective is: Australia has to be the destination of last resort for those international gangs who are ripping Australians off. Thank you.

Australian Banking Association Chair Peter King:

Thank you, Minister. I just emphasise that this is about lifting the standards in Australia across all banks. So ABA and COBA have come together to set a higher standard for managing bank accounts and making it harder for scammers and as the Minister said, it’s about making Australia a hard place.

One of the initiatives we have is unlocking high risk, money transfer processes, and in our case, we have blocked some offshore digital currency exchanges and we’ve seen customer losses fall from five million a month to one million a month. That’s about 15 million dollars a year, still too high at one million a month, but it makes a real difference.

We’re now identifying around 60% of scams and stopping them, but the good thing about today’s announcement is we’ve got an industry standard, and the ACCC has allowed the banks to share good thoughts, designs and information.

So, it’s not a competitive space, we need to lift the capability in the country, which is what we’re announcing today.

We still have more work to do in social media. If we think about the biggest loss in scams in Australia, it’s investment scams, often coming through digital platforms. So, there’s more work to do there and we will tackle that. We need to get that down but we’re making Australia a really hard place for scammers. Thank you.

Community Owned Banking Association Chair Elizabeth Crouch AM FAICD:

Thanks, Peter. Customer-Owned Banking is absolutely committed to this Scam-Safe Accord. We’ve talked about the fact that we’re working collaboratively, and as you see where we are today, there’s been a strong focus around technology and data, and we’ve been sharing data for a long time with our colleagues through the Australian Financial Crimes Exchange. We’ll continue to do that, but what we want to do is also spend the time in working with our customer to question, and to challenge, and to take the time to think about the transactions or the proposals that come to them.

You wouldn’t hand your house keys over to a criminal to go and occupy your house, and we want our customers to be thinking equally about the importance and the value of their personal data and their financial data.

So, we want to work closely with them to take the time to not be pressured, and under this Scam-Safe Accord, we’re certainly going to be working with our colleagues to make sure that we can support our customers as best they can and that they know that they can come to their bank early and get some support. So on that note, our thanks to our colleagues at the ABA, and I’ll hand it over to Anna.

Reporter: So, Anna Bligh, it sounds like part of this process is requesting greater tolerance in customers, and of course technology has allowed this rapid process of money exchange, but what you’re talking about here is literally slowing everything down. Is that correct?

Anna Bligh: As more and more customers have jumped into the world of digital banking, and we saw that get turbocharged during COVID, we need to make sure that the digital space is as safe as it can possibly be. For a long time, the digital space has valued speed, and efficiency of transfers. With some of these initiatives today, we’re going to look at slowing some of that down a little bit. That helps to give your bank the best chance of getting your money back if it does go to the wrong place. So, we do expect that customers will see particularly when you’re sending something for the very first time to an account you haven’t used before, or you’re lifting your daily limits, there might be some delays, some warnings that you haven’t seen before. So yes, get set for some of your bank transfers to be done a little differently over the next 12 months. But it’s all designed for your safety, and it’s all designed to make sure that we can win the war on scams.

Reporter: Anna, why did it take so long to implement something like this?

Anna Bligh: With some of these reforms Australia will join a handful of other countries around the world that are able to offer these protections to their customers. As you’ll appreciate these are very big systems, Australians make about 15 billion electronic transfers of money every single year. So finding and designing a system and being comfortable that it could be done accurately, reliably, and in a cost effective way so that even the smallest of banks and building societies could be part of it has taken some time. But we are now in a position where we can confidently and reliably say to customers, we know we can build this system, and we know we can build it in a way that is convenient for customers, but affordable for even the smallest of banking institutions.

Reporter: Anna, how big a target has Australia become for scammers on a global scale. Are we rich pickings?

Anna Bligh: We’ve seen scams escalate all around the world. Australia is not unique in this. Particularly after COVID, and particularly after the invasion of Ukraine by Russia. We’ve seen a big shift globally into digital banking, and we’ve seen a big shift in the ability of international very sophisticated criminal gangs. Australia is by world standards and affluent country. So yes, there are international criminal gangs who are wanting to target Australians who’ve got money in their accounts. So that means we do have to be vigilant, it means we have to look at it and continually invest in safer systems and that’s what we’re doing today. As a banking system we stand united. Credit unions, building societies, mutual banks, commercial banks, we stand united and determined to absolutely beat scammers.

Reporter: Practically what you’ve all indicated here today is we’ve got some weak spots. You’ve certainly mentioned social media, telcos as well, I don’t know who wants to answer or if you all want to answer that question, but are there definite weak spots that need to be addressed?

Anna Bligh: I’ll let the minister jump in in a minute. But the way we think about scams is how do they get to you. They generally come to you by your phone by a social media platform or a search engine. Scams don’t get to you through your bank. But once they get to you through your phone, through a search engine, then money has to be transferred around to get it to the scammer. That’s where banks and these reforms come in. And then how do they get out of the country? More often than not, they get out of the country by a high-risk cryptocurrency platform, or an account that has been set up using someone’s stolen identity. So, we need to think about it right across there if we’re going to make Australia one of the safest scam proof countries in the world and that’s what we’re determined to do.

Stephen Jones: Thanks Anna. Before the election, the Albanese government identified scams as a major weakness in our national security framework. $3 billion a year going up at about 80% a year, but no focus on it, and what seemed to be no government priority to deal with it. We said it had to be done differently. We had to keep people’s information safe, we have to keep their money safe, cyber information safe, anti-scam strategy, keeping their money safe. We promised to set up a National Anti-Scam Centre, which will be a centre of knowledge and action inside the ACCC. Focusing on investment scams as a priority and being a focal point for real time information exchange. So, if one bank is notified of a scam activity that’s going on, they can transfer that through the Australian Financial Crimes Exchange, the AFCX, and that can be transferred to the National Anti-Scam Centre. We can put alerts out around the country to ensure that every part of the ecosystem knows what’s going on, so they can take preventative action as well. The second part of the process is ensuring that we have codes of practice across the key industries. We look at this as an ecosystem and what are the key points in the ecosystem? As Anna says, they get to you via your mobile phone, over 50% of scams come to you by a text message. They come to you by a social media platform, whether it’s Facebook, or Instagram, or Google or any of these. Fake investment scams being advertised, people are losing 1000s and 1000s and 1000s on everything from fake debentures to fake bonds, to fake bank accounts, we’ve already put in place a web takedown service through ASIC have taken down about two and a half thousand websites a month on that, significant advance but more work to be done. But the work of the codes of practice will do really heavy lifting, it will ensure in the banking industry, and the telecommunications industry and the social media platforms, they all have responsibilities, but some might say ‘let’s just make the banks do it’. I want the banks to do more, let’s be very clear about that, and I welcome what’s been done today, more needs to be done. But if we only lock down the banking system, and the scams are still coming to people through social media platforms, or through the telecommunication system, we haven’t fixed the problem.

Reporter: You talk about Team Australia, who’s not being the team player?

Stephen Jones: I’m going to give everyone a good crack at doing the right thing. So, over the next month, we’ll be releasing a framework for our codes of practice. The strong expectation is that the leaders within those industries step up to the plate, and hopefully we can get agreement, if we can’t get agreement, we will mandate, and we will ensure that they’re enforceable and there’ll be consequences for breach of those codes.

Reporter: Minister, has the government given up on getting banks to reimburse victims like the UK does?

Stephen Jones: I want to say very clearly that my focus is on the obligations of banks. What is it that we’re expecting them to do to keep money safe? If we just focus on the reimbursement, the horse has already bolted. So, what can we do to stop the money leaving an account in the first place? That’s what the code of practice is all about. Obligations on how banks are keeping people’s money safe. And if they don’t meet those obligations, then we can start talking about liability. But let’s focus in the first step on what we’re asking banks to do, which was why I so warmly welcomed what has been announced today. Because I can guarantee you confirmation of payee would be in the top list of things that we’ll be asking all bank to do.

Reporter: Did you say there was three billion lost, and that had risen 80%?

Stephen Jones: It rose 80% on the year before. So, this is a massive problem. That’s why, from opposition, the Albanese government said this is not good enough. We’ve got to keep people’s money safe. We’ve got to have a national strategy to go after the scammers. It’s been great to work with the banks but we need more effort across the rest. I welcome the telecommunications companies, through the efforts of my colleague Michelle Roland, of doing SMS blocking. More needs to be done to ensure that we can lift that up as well.

Reporter: Why is there a massive increase? And in such a short period of time?

Stephen Jones: Well, as Anna said in response to a similar question, these international crime gangs look at Australia and think, well, we are relatively wealthy, high rates of mobile phone and internet usage. That makes them an easier place to go after than a country with a lower national income, less savings and less penetration of mobile phones and internet services.

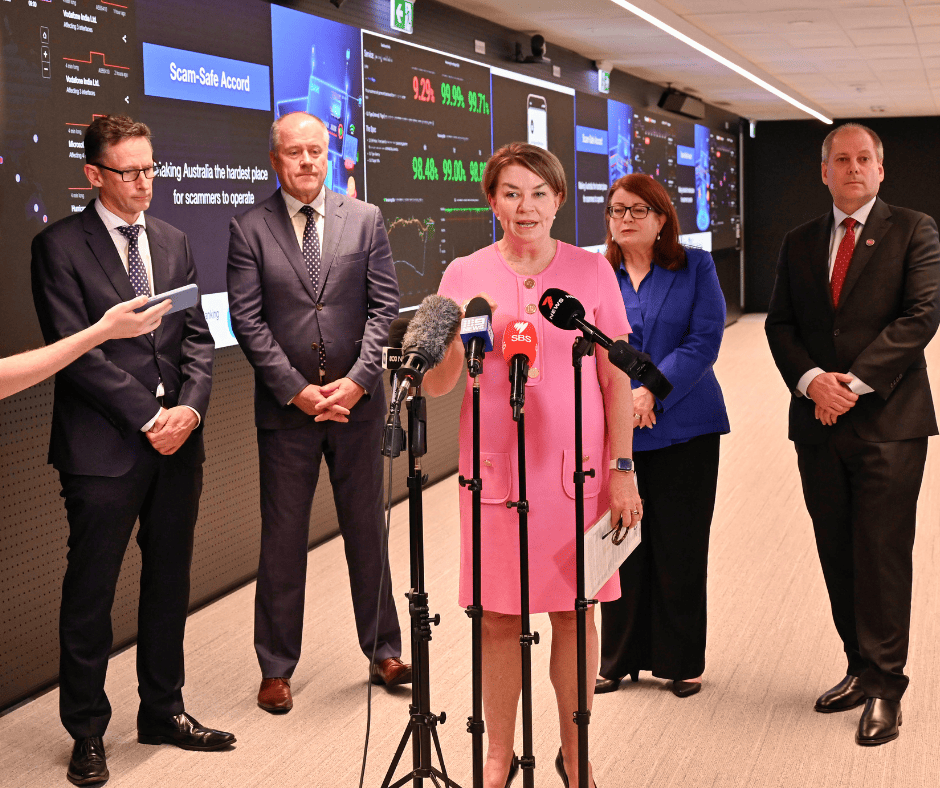

Reporter: Can I ask Peter King from Westpac, we are here in your offices, what are these people doing?

Peter King: This is one of our technology teams, as you can see on the board, there’s a lot of visual data here. They’re sort of the nerve center for controlling our operation and technology on scams and frauds. So that gives you a bit of a sense of inside the bank.

Reporter: So, they are looking for unusual activity?

Peter King: That’ll be part of the role. There are also other teams in Parramatta and Adelaide that do this work. So, it’s quite a big workforce.

Reporter: So, is there a reason the big four banks aren’t here today to announce with you are they all on board? Anna Bligh described earlier as, as unprecedented cooperation, that seems to suggest that getting cooperation like this has been difficult in the past.

Peter King: I’m here as the chair of the ABA. So that’s why we’re in Westpac. We’re hosting today. But all banks are on board and all customer owned banks are on board. And the point is, we’ve got to lift the industry to a standard because otherwise, if you don’t have a standard in the industry, water goes to the easiest route if you like. So, we’ve got to get the standard in the industry up, which is what we’ve announced today. One of the key things in banking is competition law, you have to be very careful about what you work on together. So, what has been really good today was the ACCC has provided authorisation for us to work on this area collectively. And that gets us through the potential competition issues and allows us to share good ideas and design together to get an industry standard. So that’s just the law in the country, and we’ve been able to do that. I think the other piece is, as the Minister said, the amount of money being lost by customers has gone up and we need to respond as an industry.

Reporter: So, there’s an urgency is there, as we just had this 80% increase right now.

Peter King: Or there’s an urgency but we need customers to really think about things, and investments, if they’re too good to be true don’t invest in them would be a simple message. And the banks will do what they can to stop the movement of money, but we’ve also got to do more up the chain, stopping people getting dodgy investment opportunities.

Reporter: In a way the best vigilance is by the customer ultimately.

Peter King: We will help them. So as an example of the friction we will put in, we will start sharing some of the insights we get out of the data analysis. We’ll ask questions like, Did you get this message from WhatsApp? Do you know it’s the Hey Mum request coming through WhatsApp, to make a payment because I’ve lost my credit card and I’m in a supermarket needing to pay for groceries. That still exists. So, we’re going to prompt people when they’re making payments with questions, that will hopefully make them ask the question and make a better decision.

Reporter: Hey, Peter can I answer one more question, we often talk about and hear a lot about these things being unprecedented. How do you welcome that you’ve had this opportunity to build this wall, like what we’re seeing there behind as part of the wall you’re all building together. You’re actually doing something?

Peter King: Well, I think if you step back, what’s the role of banking? A big part of it is to move money. And a big part of it is trust and keeping people safe. So, for me, one of the great things about today is we’re back to the purpose of what banking is about. We’re obviously moving money, we’re going to make it a little bit slower so people can make better decisions, but helping people make better financial decisions is part of banking, and part of why we exist and so that’s what’s really exciting from my perspective today.

Reporter: [Inaudible]

Peter King: Do you want to cover that terms of the industry code?

Stephen Jones: Obviously, when people are losing $3 billion a year and a big amount of money has been lost to false invoice scams, or investment scams. People are asking two questions; how can I get my money back? And how can we stop this sort of thing? My focus is on how we can stop it, and I do want to put my obligations on banks, I do. But I’m going to draw the line short of saying banks are always liable. Because there’s two reasons why you wouldn’t want to do that. You don’t want to create a honeypot, where we have a situation where criminals sitting in unfavorable countries around the world say ‘let’s go to Australia, because that’s a victimless crime there.’ ‘If we hit the banks up, who cares?’ The customer will always be refunded. That is a powerfully bad incentive for us to put in place. That doesn’t mean banks get a green light, they have to lift their standards, and ensure that they have put more safety practices in place, like the ones announced today. Plus more that we’ll be working on and making mandatory through an industry code. And if they don’t meet those industry codes and those obligations, absolutely, liability will follow.

Reporter: [Inaudible]

Stephen Jones MP: I know nothing more on that than what has been reported in the press this morning. You’ll have to follow up with my colleagues, Claire O’Neill or Andrew Giles.

Reporter: [Inaudible]

Stephen Jones: I really encourage you to follow those matters up with my colleagues who will be able to answer them fully. I’m really focused on scams and protecting Australians from $3 billion worth of losses.

Reporter: Elizabeth for the smaller banks, how does it feel to be part of this wall that’s being built?

Elizabeth Crouch: Look, I think it’s important for us all collectively, as Peter and the Minister said, to lift our capability. In a number of areas customer owned banks, of course, are very close to the customer. So we have the advantage of that close engagement with them, and that will allow us to work on these sorts of initiatives and take them on that journey with us. So it’s not without its challenges, of course, but we have a history of being fairly innovative and creative and finding solutions for the customer. And in relation to this Scam-Safe Accord, we’re going to do exactly the same thing. So we’ve collaborated as a sector in the past, and done a bunch of things to lift capability across the sector. This is no different.

Reporter: On your comments about capping international student numbers. Will your government look at reducing migration numbers across the board, given the housing prices and the inflation problems?

Stephen Jones: Sounding like a bit of a squeaky wheel here. These are questions are best put to the minister Claire O’Neil and Andrew Giles who pick up responsibility for this policy area.

Reporter: Are you worried that one third of super customers are vulnerable to self managed fund fraud? Is it an area that you will look at?

Stephen Jones: Look, I’m starting with the biggest part of the biggest problem. And not every Australian has an SMSF but every Australian has a bank account. So let’s start there and once we’ve dealt with that, we’ll move out to other parts of the economy where there is obvious risks. So yes, I’ll look at superannuation. Yes I’ll look at insurance, Yes, I’ll look at cryptocurrency. But let’s deal with the biggest part of the biggest problem, so my focus over the next few months is banks, telecommunications companies, social media platforms, and then we’ll start working out from there. Thanks so much.

ENDS

Latest news

Michael McLaren (Host): Well, here we are at the Easter Show, the great celebration of country life in the city, but it’s also an important platform this to better understand the challenges that the regions face. Now, yesterday, we looked at the floods. Today, I want to look at the banks. Now in the regions,… Read more »

The ABA is reminding customers across North and Far North Queensland that they don’t have to tough it out on their own, as they continue to recover from February’s severe flooding event. ABA CEO Anna Bligh recently met with Queensland’s State Recovery Coordinator Andrew Cripps to discuss how banks can assist customers facing financial difficulty… Read more »

Banks stand ready to support customers in western Queensland and parts of New South Wales affected by heavy rainfall and flooding. ABA CEO Anna Bligh said customers don’t have to tough it out on their own and banks have a range of practical measures to assist those facing financial stress. “This is a challenging time… Read more »