2 May 2023

The RBA continues to address the nation’s inflation challenge with today’s 0.25% increase.

Last week’s inflation figures showed a 1.4% increase for the March quarter. This is a 7% increase in the past year which indicates the cost-of-living challenge faced by Australian households.

The ABA encourages those customers who are concerned about their financial situation to shop around to find the most suitable deal for their individual needs. Competition in the banking sector is strong and record levels of mortgage refinancing continues.

Banks strongly encourage any customers experiencing financial difficulty to reach out to access bank support services and to do so as early as possible. Bank support teams are also proactively communicating with those customers at risk.

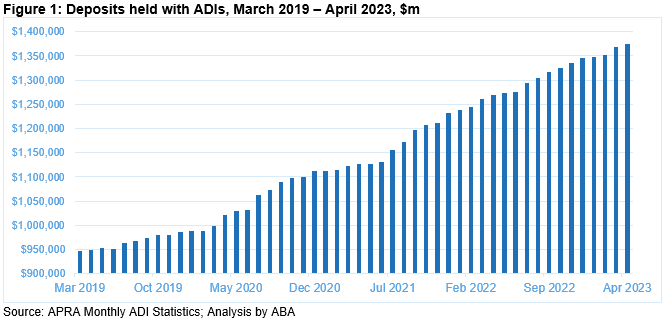

Australians have record levels of savings sitting in deposit and offset accounts while arrears remain at low levels. In April 2023 the value of household deposits on the books of ADIs grew for the 23rd month in a row, to $1.37 trillion.

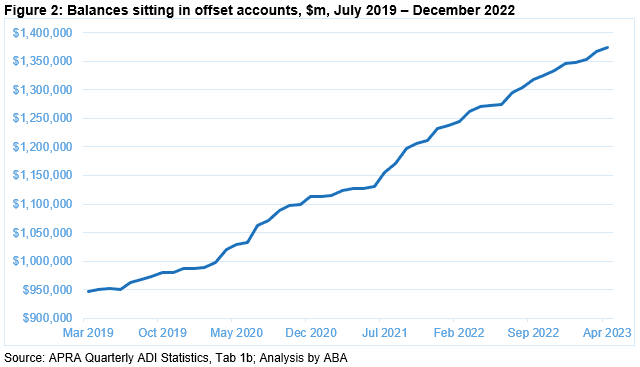

At $244b, there is now more sitting in mortgage offset accounts than ever before. In fact, there has been a growth of 42 per cent since December 2019 (Figure 2).

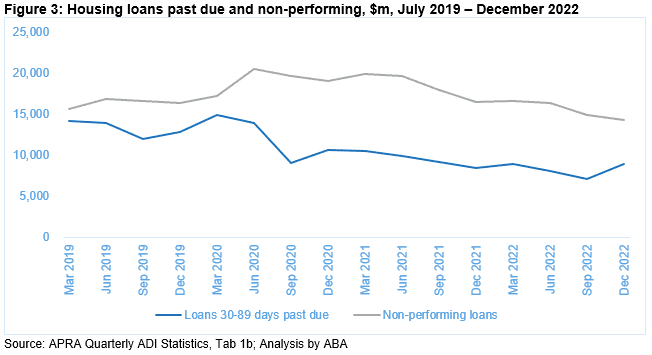

The value of non-performing loans (i.e. those 90+ days in arrears) fell in the last quarter of 2022, while loans 30-89 days past due has increased slightly, though remained below pre-COVID levels (Figure 3). The proportion of non-performing loans relative to the housing portfolio now sits at 0.59 per cent, down from 0.62 per cent in the September quarter and 0.79 per cent in December 2019.

Latest news

Michael McLaren (Host): Well, here we are at the Easter Show, the great celebration of country life in the city, but it’s also an important platform this to better understand the challenges that the regions face. Now, yesterday, we looked at the floods. Today, I want to look at the banks. Now in the regions,… Read more »

The ABA is reminding customers across North and Far North Queensland that they don’t have to tough it out on their own, as they continue to recover from February’s severe flooding event. ABA CEO Anna Bligh recently met with Queensland’s State Recovery Coordinator Andrew Cripps to discuss how banks can assist customers facing financial difficulty… Read more »

Banks stand ready to support customers in western Queensland and parts of New South Wales affected by heavy rainfall and flooding. ABA CEO Anna Bligh said customers don’t have to tough it out on their own and banks have a range of practical measures to assist those facing financial stress. “This is a challenging time… Read more »